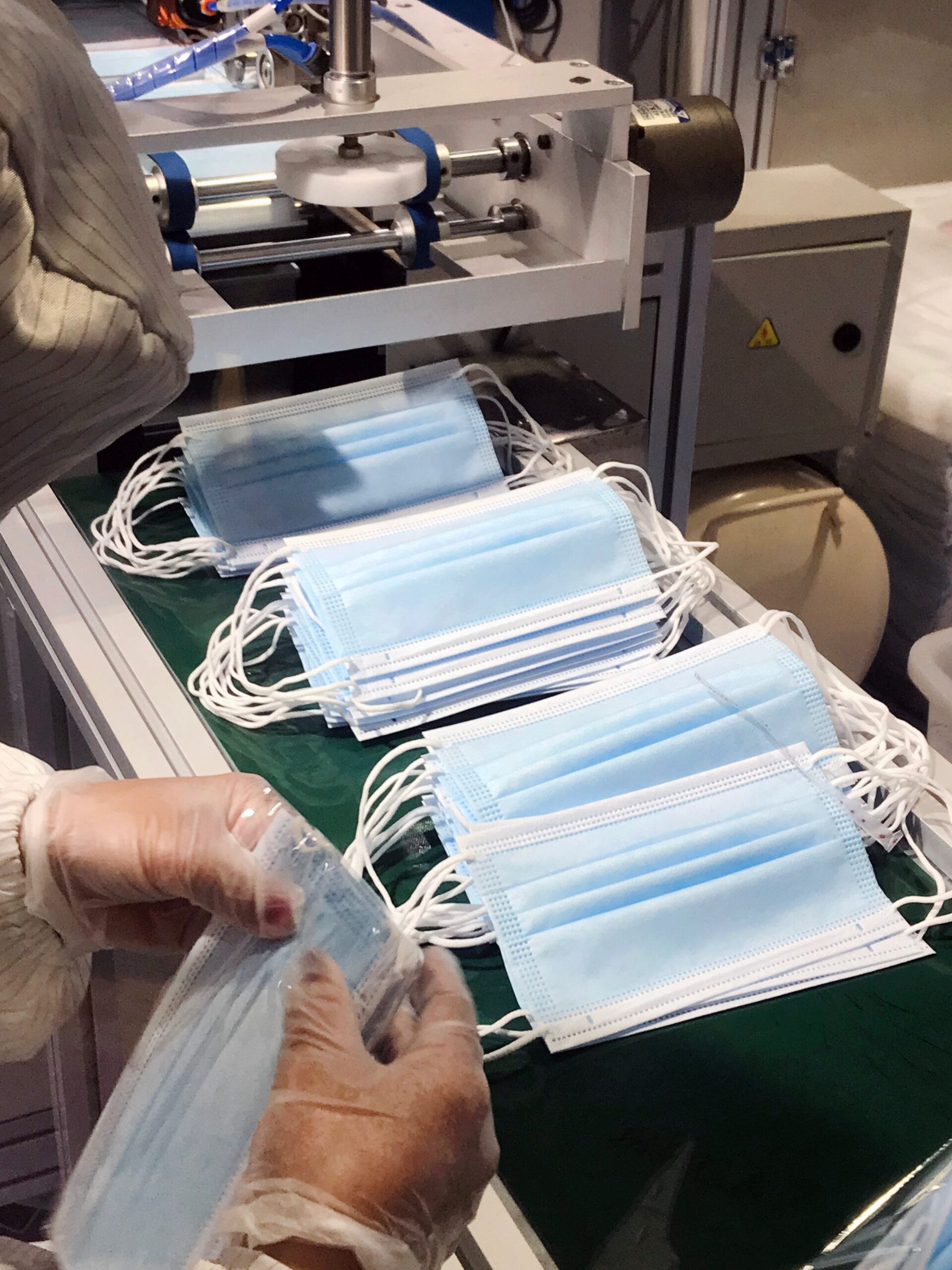

Masks and Face Shields Will Become Tax-Free, Starting Next Week

In the Fall Economic Statement 2020, the Government of Canada has decided to ‘zero rate’ the Goods and Services Tax/Harmonized Sales Tax (GST/HST) of face masks, face shields and respirators that meet certain specifications, for batches produced after December 6th.

The specifications for said face masks/shields/respirators are as follows:

- A face mask or respirator that is authorized for medical use in Canada, or meets N95, KN95 or equivalent certification requirements and does not have an exhalation valve or vent.

- A face mask or respirator for use in preventing the transmission of infectious agents, such as respiratory viruses, and that meets the following specified construction requirements:

- is made of multiple layers of dense material, but may have a portion in front of the lips made of transparent and impermeable material that permits lip reading provided that there is a tight seal between the transparent material and the rest of the face mask or respirator;

- is large enough to completely cover the nose, mouth and chin without gaping;

- has ear loops, ties or straps for securing the face mask or respirator to the head; and

- does not have an exhalation valve or vent.

- A face shield that has a transparent and impermeable window or visor, covers the entire face and has a head strap or cap for holding it in place, but is not specifically designed or marketed for a use other than preventing the transmission of infectious agents, such as respiratory viruses.

It was also said in the statement that this measure is “proposed to only be in effect until their use is no longer broadly recommended by public health officials for the COVID-19 pandemic”, so we may be expecting a visible increase in market need for the forementioned supplies in near future. Since there will always be at least a handful of fellows in any neighbourhood who’d ‘prepare to the max’, it really wouldn’t be surprising if they were to stock pile some face masks while they are cheap.